IndiHome Tawarkan Bonus Langganan Gratis HOOQ Selama 2 Bulan

The IRS considers a bonus check to be "supplemental wages" so it is generally taxed at a flat 22% tax rate since it is income that is above and beyond your normal salary. Other supplemental wages can include accumulated sick leave, commissions or overtime pay. There is also an aggregate method for taxing bonus checks if your company.

Daftar Harga Paket Indihome perbulan dan Promo ! Paket INDIHOME

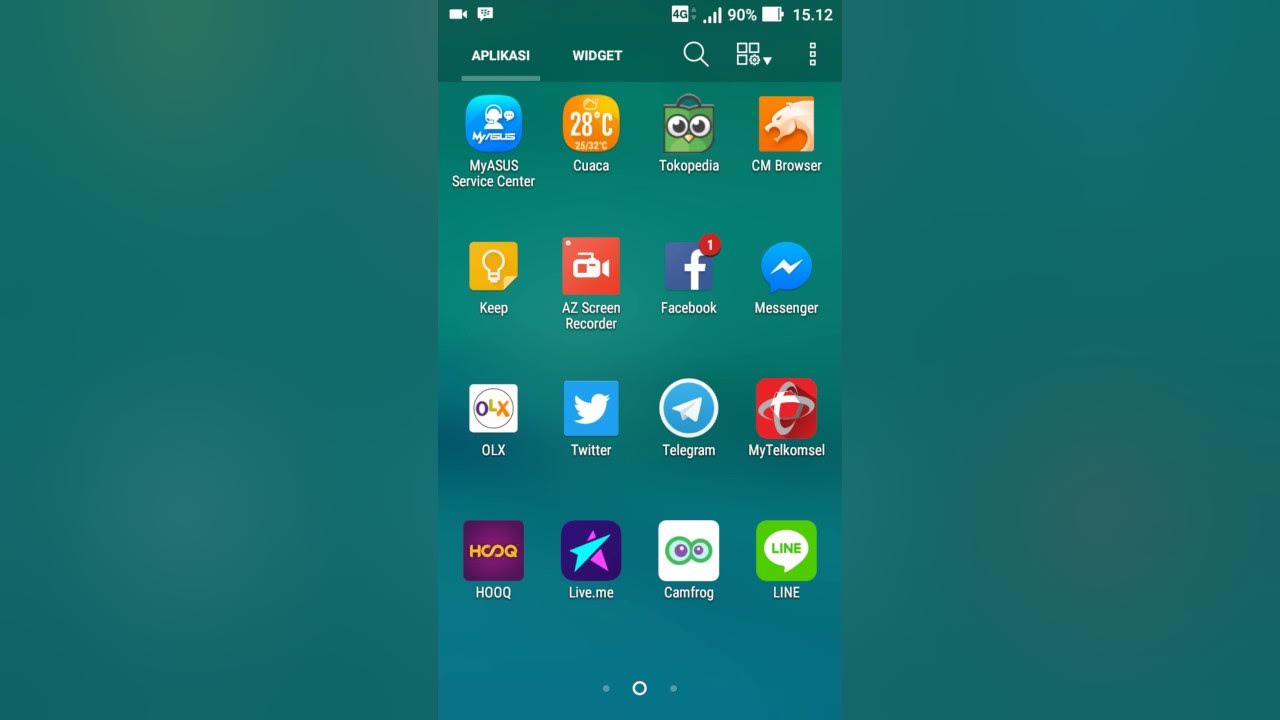

Oke berikut cara sederhana download film di hooq dari hp androidhttps://www.riaume.comKuota di gunakan ketika unduh film ada bonus hooq dari telkomselPilih u.

HOOQ dan Indosat Ooredoo Hadirkan Promo Murah Buy 1 Get 3 Gadgetren

1. Annual Bonuses: Many companies provide yearly bonuses to employees, typically at the end of the fiscal year. These bonuses are often based on overall performance, company profitability, or individual contributions over the year. 2. Performance-Based Bonuses: Bonuses can be given when employees achieve specific performance goals or targets.

HOOQ launches 'free' feature for easy access to content ABSCBN News

4 min How are bonuses taxed? It depends on how your employer pays you. Fidelity Smart Money Key takeaways The federal bonus tax rate is typically 22%. However, employers could instead combine a bonus with your regular wages as though it's one of your usual paychecks—with your usual tax amount withheld.

HOOQ Demise Damages The Business Case For Southeast Asian Streaming Variety

PNC Bank Virtual Wallet Checking Pro: $200 bonus offer. PNC Bank Virtual Wallet: Up to $400 bonus offer. SoFi Checking and Savings: Up to $300 bonus offer. Best bank bonuses for savings. Alliant.

HOOQ Tayangkan Streaming AAA, Gratis! Unbox.id

A bonus calculator for taxes is a valuable tool for estimating the tax on your bonus. By entering information such as your standard wages, bonus amount, and filing status, you can get an estimate of the tax to be withheld. This helps in planning your finances and understanding the impact of the bonus on your overall tax situation.

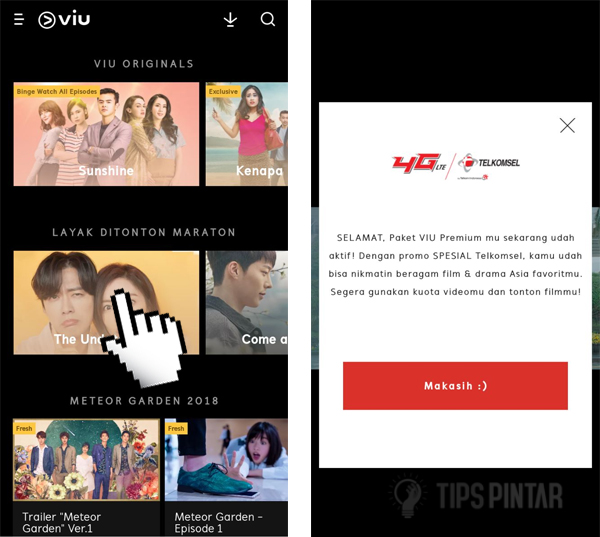

Cara Menggunakan Bonus Streaming Di Smartfren

By subscribing to HOOQ through Globe at Home, Globe postpaid or any of the standalone HOOQ plans, you get one bonus ticket every month to rent a movie among the TVOD titles. The list changes every month, which means you can have a new movie every month, too.

Cara Menggunakan Bonus Hooq Dan Viu

Sign-on bonus: A sign-on or signing bonus is a sum of money paid to new employees upon hire and is determined while negotiating a job offer. Employers use this type of bonus as an incentive to garner more interest in open positions. Sign-on bonuses are commonly seen in sales roles.

Buka Akses ke Layanan Video Streaming Hooq, Aplikasi Grab Jadi ‘Super App’ Mobitekno

With this tax method, the IRS taxes your bonus at a flat-rate of 25 percent, whether you receive $5000, $500 or $50 — however, if your bonus is more than $1 million, the tax rate is 39.6 percent. This percentage method may seem ideal as it tends to take less out of your bonus, which means more money for you initially, but be prepared to pay.

Cara Daftar HOOQ GoldPlus, Hanya Melalui 3 Langkah Mudah Full! HOOQ

The bonus tax calculator calculates the take-home bonus pay after-tax deduction using flat percentage and aggregate method. Welcome to the Bonus Tax Calculator, our free online tool that helps you to get an estimated bonus tax after the deduction of federal tax, state tax, social security tax, and Medicare tax.

OTT platform Hooq launches new campaign and doubles down on original programming Mumbrella Asia

Compensation Structures What is a Bonus? 8 Types of Bonuses + How They Work By The Salary Project June 7, 2022 What's the deal with bonuses, and how can I negotiate a bonus structure? We're talking all about bonuses. If you're looking for a job with a decent base salary plus a lucrative bonus structure, you've come to the right place.

Cara Menggunakan Bonus Hooq Dan Viu

The bonus tax rate is 22% for bonuses under $1 million. If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over that gets taxed at 37%. Many.

Cara unduh atau download film di hooq bonus telkomsel YouTube

The percentage method is used if your bonus comes in a separate check from your regular paycheck. Your employer withholds a flat 22% (or 37% if over $1 million). This percentage method is also used for other supplemental income such as severance pay, commissions, overtime, etc. Supplemental wages are still taxed Social Security, Medicare, and.

Hooq Launches AmazonStyle Pilot Season to Find Its First Asian Original Entertainment News

A bonus is a form of compensation employers pay their workers over and above their regular wages. Employers often distribute bonuses near the holidays, at the end of the company's fiscal year, or once an employee reaches certain goals. However, employers can disperse bonuses at any time throughout the year, if they choose to offer them at all.

Netflix rival Hooq files for bankruptcy TNGlobal

If the bonus is in excess of $1 million, it is taxed at a rate of 37%. This means that if your bonus is $10,000, and you are taxed using the percentage method, $2,500 goes to the IRS. This method is easy to calculate for both employee and employer because the bonus is taxed at a flat rate. To compute your take home pay based on the Percentage.

Asyik! Pelanggan IM3 Ooredoo Dapat Bonus Tambahan Langganan Hooq

These bonus tickets are redeemable within 30 days from the time they're awarded. Local or foreign, film or series, HOOQ's diverse catalog covers all bases. Watch them on the app, stream at home via Globe Streamwatch or Chromecast, or download them for offline viewing.